Licensing

Building, buying, and operating as a money services business, money transmitter, or consumer lender

Are you concerned about multiple partnerships as a single point of failure? Or launching a new product that requires licensing?

Whether primarily operating as a software as a service provider seeking to add payment or lending functionality or a payments focused model, there are multiple paths to operating compliantly. Stratis Advisory can help you assess the short-term and long-term benefits and tradeoffs of utilizing a partnership model to enable financial services or whether owning the financial services under a licensed entity is the best strategic fit for your organization.

Control your own destiny by operating as a licensed lender or

money transmitter.

Operating as a regulated entity requires an investment in time, funding, and resources. Unlike the partnership model where you pay a premium to mitigate certain risks, have limited banking partner options, and are always in a subservient position, regulated entities gain access to top tier global banks, higher margins, product flexibility, and investor confidence.

Building a Licensed Money Transmitter

A Roadmap to Obtaining Money Transmitter Licenses

Operating as a money transmitter, and depending on your specific business model, typically, you will need to obtain money transmitter licenses (MTL), or exemptions to licensure, in each state where you seek to operate. As of January 1, 2025, all US states and territories regulate money transmission activity, except Montana. MTLs are usually required if you receive customer funds to transmit them to third parties.

The MTL journey begins with identifying the states you want to obtain licenses, when, and why. From there, understanding the states with enhanced licensing requirements such as New York, which includes Part 500 (cybersecurity) and Part 504 (monitoring and screening systems) programs, that will impact your strategy. You will need to understand the nuances of the MTL application process to increase your likelihood of success to manage timelines, internal expectations, and cost.

Post-licensure, the focus shifts to maintaining the licenses through quarterly and annual reporting, annual license renewals, single and multi-state examinations. To successfully operate your business as a licensee, you will need to plan for ongoing operational capacity of multiple programs from finance to cybersecurity to anti-money laundering compliance. Typically, issues begin to percolate when the licensee does not mature, grow, and scale compliance programs from basic documentation to operationalized processes.

Examinations focus extensively on operational execution of governance, operations, finance, cybersecurity, and compliance. Poor examination ratings result in costly remedial measures, possible public civil money penalties or settlements, and enhanced oversight or de-risking from your bank partner.

Buying a Licensed Money Transmitter

A Decision Framework for Acquiring Licensed Money Transmitters

Acquiring a licensed money transmitter may help you leapfrog the license application part of a licensing roadmap and thereby gain some speed to market advantage. At first look, an acquisition appears to be the fastest, cheapest, and most efficient method to acquire a host of money transmitter licenses (MTLs).

However, the success of any MTL acquisition hinges on regulatory approval of the advanced change notice (ACN) for the proposed change in ownership, which is predicated on a certain similarity of business activities between you and the entity you are targeting to acquire.

Acquiring an active MTL enables you to shortcut the time it takes to go through the state-by-state MTL application process. Depending on the jurisdictions of MTLs in your target’s portfolio, you may be gaining anywhere from 2-3 months to over 18 months. The value of the speed to market you may gain is discounted by any liabilities associated with each MTL going back to the day it was initially approved.

Starting on the day of successful completion of the ACN process when a state regulator approves the transfer of an MTL, you will need to be in the position to demonstrate that you have met all regulatory requirements applicable to you as the licensee. Day one readiness means you will need to clean up the past, while complying your new obligations as licensee.

Registering and Operating as a Money Services Business

Compliance Program Building to Bank Due Diligence

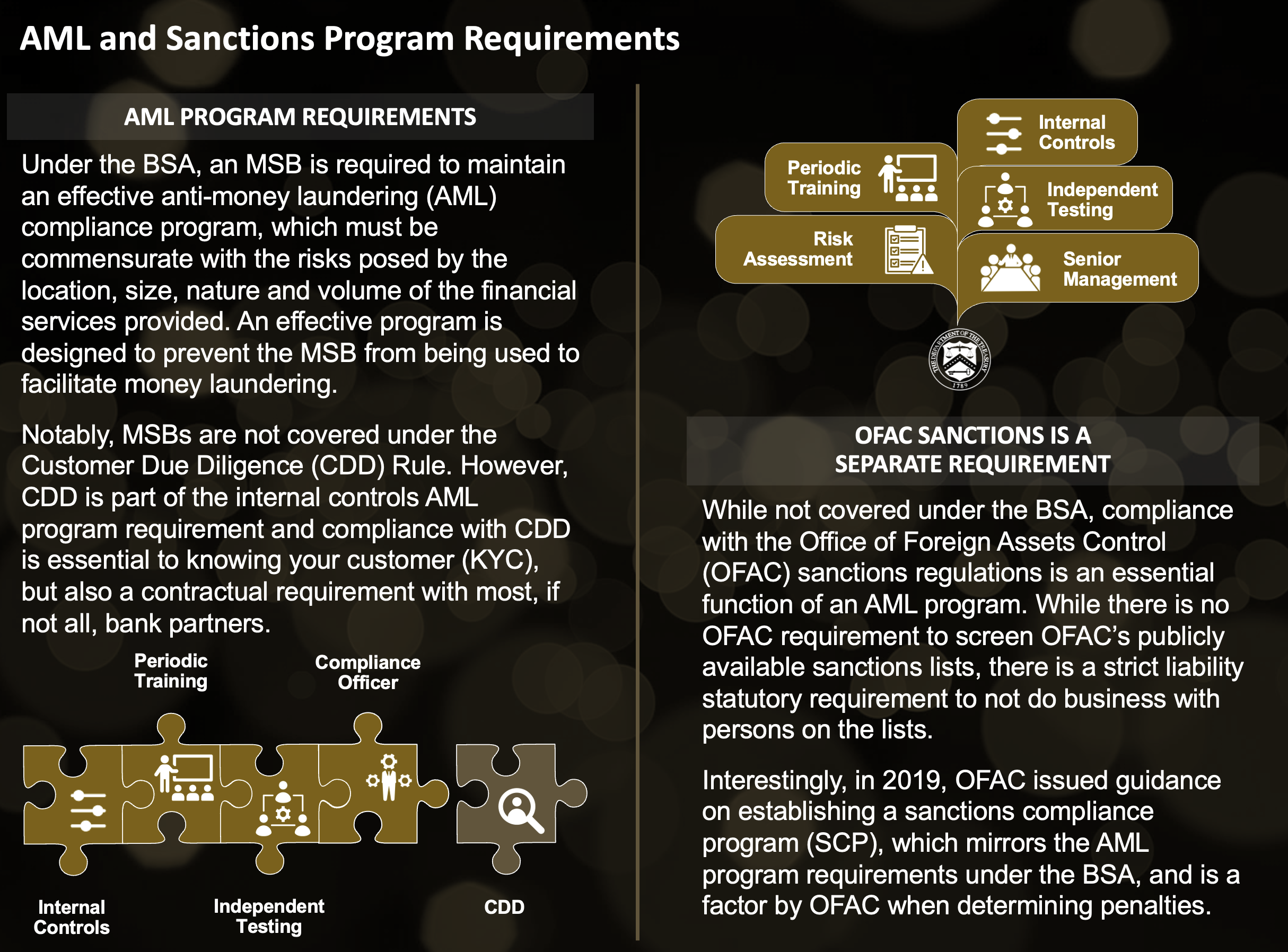

Money services businesses (MSB) are considered financial institutions under the Bank Secrecy Act (BSA) and are required to register with the Financial Crimes Enforcement Network (FinCEN). While registering as an MSB is rather straightforward, the impact is significant. Similar to banks and broker dealers, MSBs must comply with a broad set of anti-money laundering (AML) program and BSA recordkeeping and reporting requirements, inclusive of suspicious activity reporting (SARs).

MSBs are also subjected to Title 31 BSA examinations and extensive onboarding and monitoring from banking partners.Typically, banks classify MSBs as higher-risk and onboarding can be a six (6) to 12-month process and may include the following:

- Platform and funds flow reviews;

- Board-approved policies and procedures;

- Compliance officer experience and staffing;

- Review of the AML program independent review;

- Review of transaction monitoring and sanctions screening systems; and

- Fraud, complaints, and cyber incident processes.

Post-approvals, the MSB will be subjected to ongoing reporting and monitoring, and an annual review process, whereby a dedicated compliance team reviews the MSB and issues a report with remedial items to maintain an account.

Ongoing Money Services Businesses Reporting and License Renewals

MONEY SERVICES BUSINESSES | US

The BSA requires a MSB performing certain services to register with FinCEN. The owner or controlling person of the MSB must initially register with FinCEN within 180 days after the MSB establishment date.

MONEY TRANSMITTER LICENSING | US

All US state-licensed money transmitters are required to complete the MSB Call Report, which includes national and state-level MSB financial and transactional data submitted on a quarterly and annual basis through NMLS.

MONEY TRANSMITTER LICENSING | US

Companies with state licenses managed through NMLS are required to renew their licenses on an annual basis. The NMLS renewal period is from November 1 until December 31. However, state agencies may impose different submission deadlines.

New York Annual Compliance Certifications and Reporting

AML AND SANCTIONS PROGRAMS

PART 504 CERTIFICATION | NEW YORK

All NYS DFS Covered Entities must establish and maintain transaction monitoring and OFAC sanctions watchlist filtering programs and are required to annually certify compliance by April 15 with Part 504.

CYBERSECURITY PROGRAM

PART 500 CERTIFICATION | NEW YORK

All NYS DFS Covered Entities must establish and maintain a cybersecurity program and, absent an exemption, are required to annually certify material compliance or an acknowledgement of noncompliance by April 15 with Part 500.

CYBERSECURITY INCIDENT

PART 500 | NEW YORK

All NYS DFS Covered Entities are required under Part 500 to report the occurrence of a cybersecurity event as soon as possible, but no later than 72 hours.

415.352.1060 2193 Fillmore Street, Suite 1

San Francisco, CA 94115

RISK | STRATEGY | CYBER COMPLIANCE MANAGEMENT

© 2025 Stratis Advisory LLC. All Rights Reserved.

Terms of Use | Privacy Policy