Initial Public Offerings

Operational readiness of regulated and partner-based financial services-enabled platforms before an initial public offering (IPO)

Have you assessed your risk, cybersecurity, compliance, and governance programs before filing your IPO?

As a technology provider with payment or lending functionality, the basic surface level IPO due diligence performed by generalists following an outdated checklist for technology-only companies will not identify operational risks percolating beneath the surface. Stratis Advisory specializes in helping companies look deeper to assess their enterprise-wide risk, cybersecurity, compliance, and governance programs to identify aging technologies and processes, weak control environments exposing undue risk, and widening gaps due to underfunded investments that may break during your IPO roadshow impacting investor confidence and share price.

Get ready early for your IPO filing. The basic technology company due diligence is no longer suitable for financial services-enabled technology companies handling customer funds.

Financial services-enabled technology companies require enhanced risk and governance controls. Start early to identify lagging controls, weak customer verification counts, and operational inefficiencies that will undermine investor confidence. With more than 10 years of launching, scaling, and optimizing venture-capital backed financial services-enabled technology companies, Stratis Advisory brings the specialized experience to assess the risk and controls of globally licensed or partnership-model based companies preparing for an IPO to identify enterprise risks early, prioritize budgets, and execute remedial efforts to minimize required filing disclosures.

Assessing Operational Readiness Before Filing your IPO

Assessing, Identifying, and Remediating Risks Before an IPO Filing to Minimize Required Disclosures

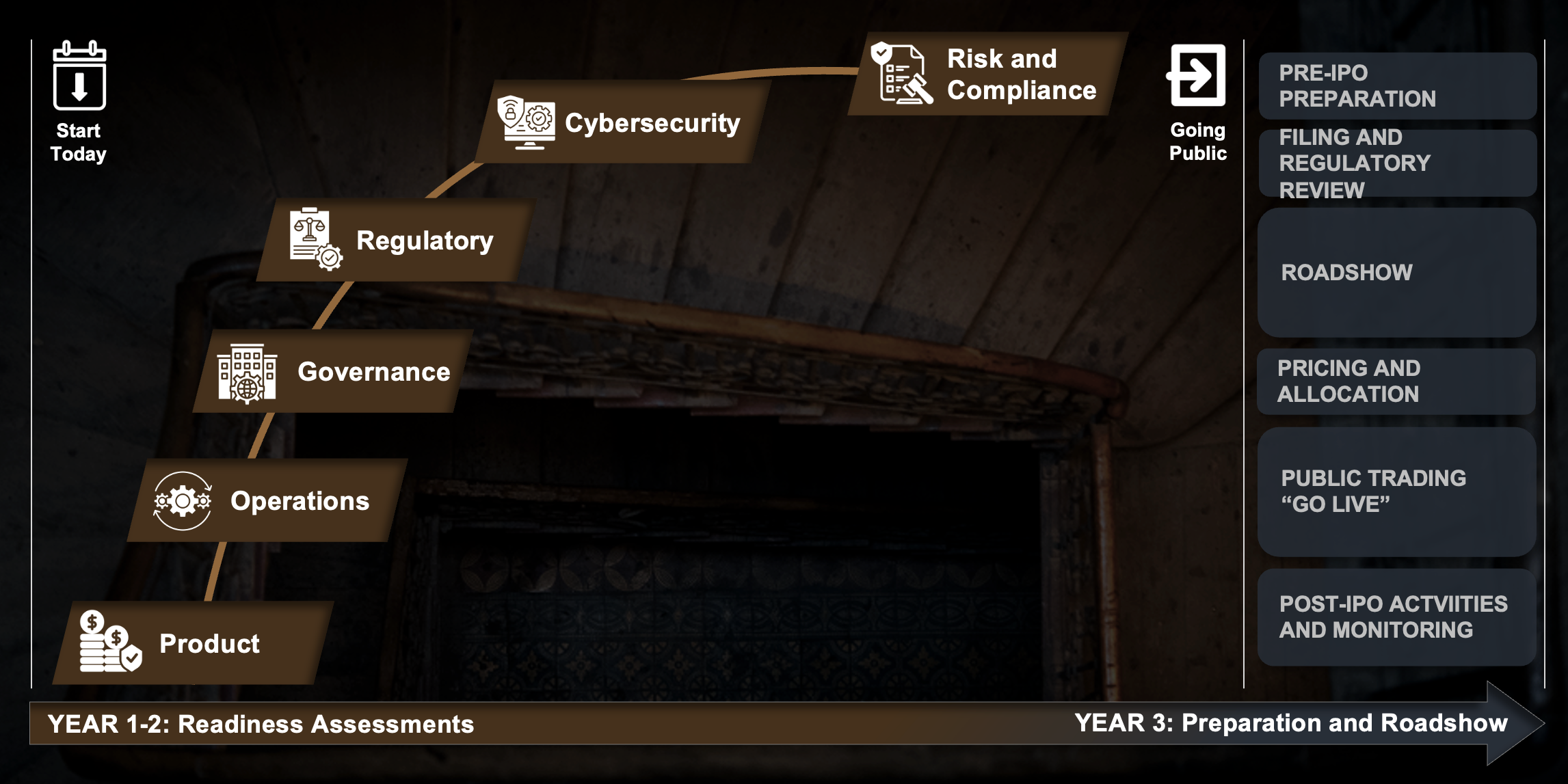

Know your enterprise-wide operational compliance and technology gaps with enough time to remediate, get the board buy-in and budget, and deliver a clean company for your IPO. Readiness should be conducted one to two years before an IPO filing to identify risks, allocate budget, and remediate key weaknesses to reduce disclosures and manage the roadshow narrative. Moreover, readiness should include assessing operations, governance, regulatory compliance, partnerships, cybersecurity, and risk and compliance.

On the Clock: The Countdown to your IPO

Preparing Critical Materials and Functions During the Time-Sensitive IPO Filing Window

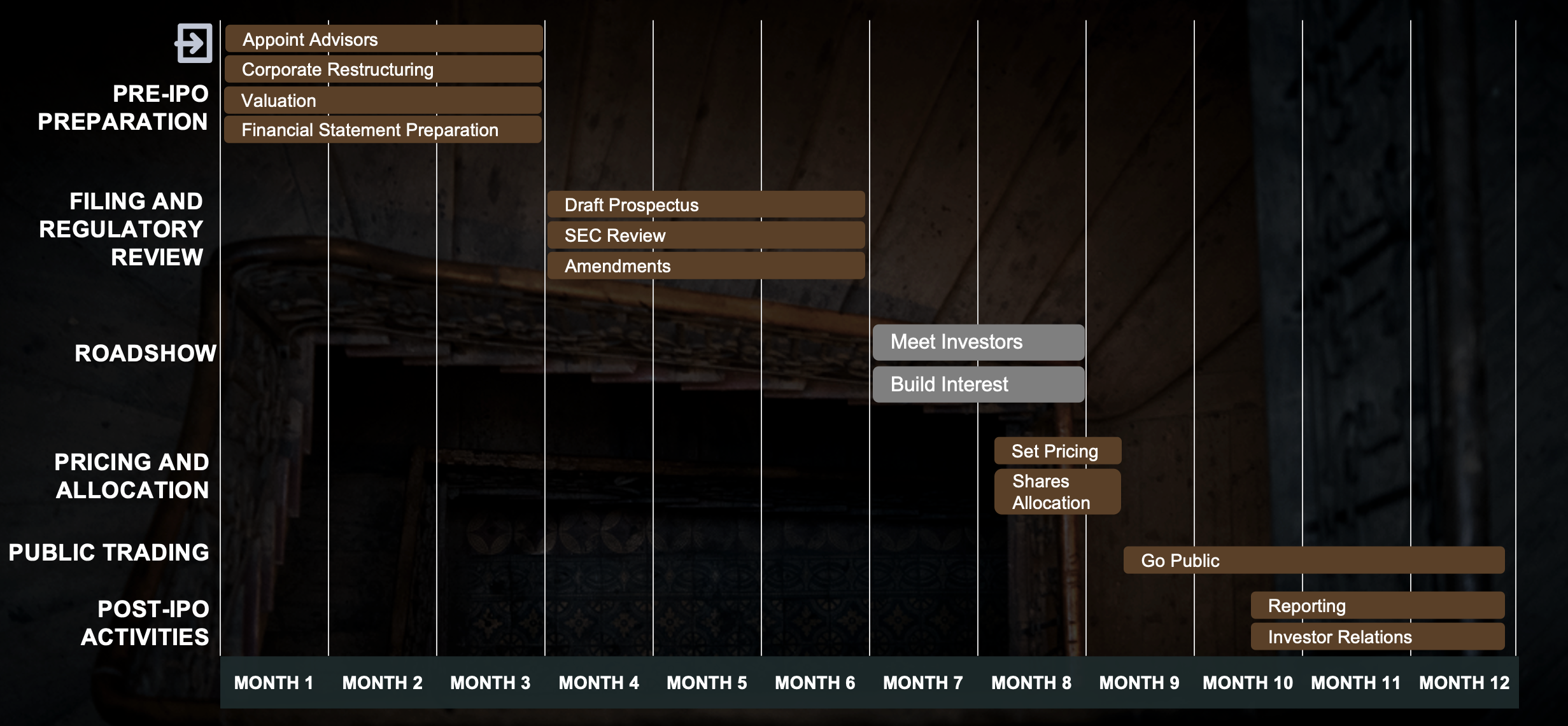

The general timeline for an IPO in the US typically follows a structured process, which spans 9 to 12 months. While the SEC process involves rigorous preparation of filing a registration statement, an IPO roadshow helps build interest for potential investors by formally presenting the company’s growth potential, competitive advantages, and financial performances.

Notably, the IPO journey includes critical steps a company must undertake to go public. All operations must be aligned with strategic goals and regulatory requirements. This provides a stable foundation for compliance and transparency. Once an IPO-readiness check is complete and the company has a well-structured, risk- resilient profile, companies should start with the preparation phase.

Key Elements of Executing your IPO Roadshow

Core Risk and Compliance Components to be Addressed During the IPO Roadshow

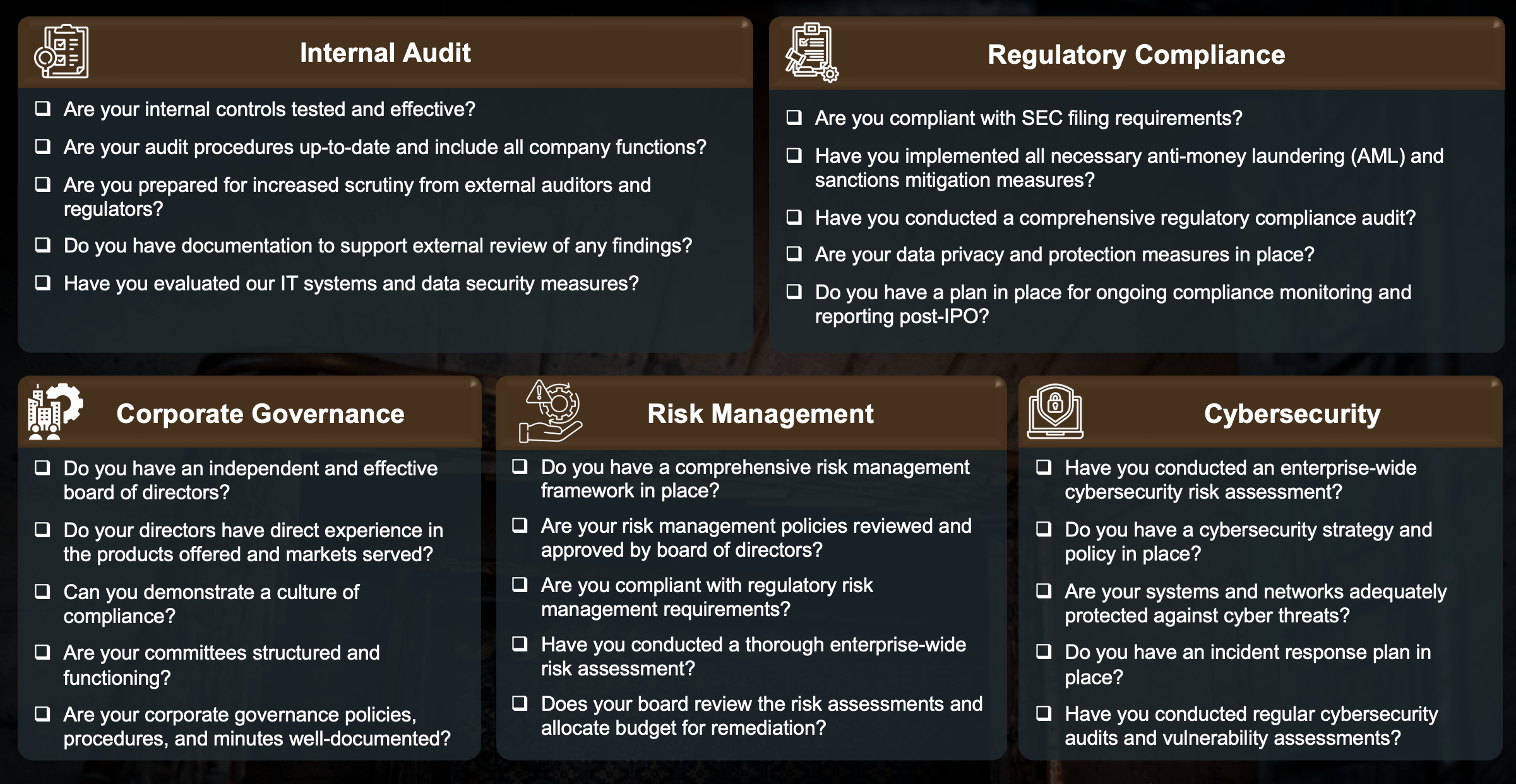

The roadshow is a series of presentations created by the company to attract potential investors and build interest in the upcoming IPO. A roadshow provides direct engagement with investors and the company can build trust and confidence in its prospects. More importantly, the roadshow helps position the company in the market pre-and-post IPO.

The company needs to prepare critical key risk and compliance components that are based on SEC regulations or requirements. These activities play a vital role for the company, the company’s audience, as well as the regulatory compliance of a company going public.

415.352.1060 2193 Fillmore Street, Suite 1

San Francisco, CA 94115

RISK | STRATEGY | CYBER COMPLIANCE MANAGEMENT

© 2025 Stratis Advisory LLC. All Rights Reserved.

Terms of Use | Privacy Policy