Crime $cenes

Stratis Advisory serves as technical advisors to major film and television studios from the writers’ room to production teams on bringing authenticity to scenes involving money laundering, terrorist financing, fraud, corruption, etc. With Crime $cenes, we analyze scenes from various film and television series to highlight how the underlying details are applicable in the real world.

The Wire, Season One (2002)

Follow the Drugs Shifts to Follow the Money

The Wire, the acclaimed five-season HBO series, starts off Season One with police officers in the City of Baltimore trying to solve murders by drug gangs in the inner-city projects. Each successive season shifts the primary storyline to other parts of life, such as the unemployment in the local dockyards, a failing education system, corruption in political campaigns, and finally, the printed press, however, the underlying theme across all seasons is the drug game.

In Season One, after several episodes of the police trying to identify the drug kingpin, Avon Barksdale (Wood Harris) of the Towers and Low Rises, the two main distribution areas in the projects, a team of detectives is assembled to figure out who is responsible for the murders, but also who is the drug kingpin. The ‘wire’ is because the police obtain a warrant and install a wiretap on the pay phones used by the drug dealers in the Low Rises. The net result is they slowly start to identify the key players of Barksdale’s network through surveillance techniques.

However, one detective, Lester Freamon (Clarke Peters), seeks to follow the paper trail by using publicly available records to determine what, if anything, Barksdale owns, i.e. the integration of his narcotics proceeds. Integration is the third stage of the three stages of money laundering, which is where the illicit funds are used in everyday life and the original source of funds has been obfuscated. In providing instructions to two other officers, Freamon believes Barskdale is using front companies, such as a night club named Orlando’s, which he considers a limited liability company or LLC, to launder the funds.

Typically, this is performed by commingling the cash proceeds of the narcotics sales on the street with the regular or irregular sales of a cash intensive-business such as a night club. Orlando’s is owned by the bartender with the same namesake, however, in reviewing public records, the address on the ownership documents matched the address of D&B Enterprises – the ‘D’ is for D’Angelo, Barksdale’s nephew, and the ‘B’ is for Barksdale. From there, Freamon instructs another officer to review the corporate records of D&B Enterprises that will identify any names or signatures in those documents just like a scavenger hunt.

When Freamon is questioned by his colleague as to what happens if they can’t find Barksdale’s name on anything, Freamon states that someone’s name must be on a piece of paper, typically a friend, cousin, girlfriend, confident, lieutenant, etc., i.e. someone he can trust. He clarifies ‘if you follow drugs, you get drug addicts and drug dealers, if you follow the money, you have no idea where the F*!% it’s gonna take you.’

To wit, Freamon and the team follow the money, but they also follow one of Barksdale’s lieutenants, Stringer Bell (Idris Elba), to university where he is attending a business class. From there, Bell tries to legitimize himself and Barksdale’s drug proceeds into a real estate venture and by seeking influence with a slick local politician, Clay Davis (Isiah Whitlock, Jr.), to make it rain.

Sicario (2015)

Follow the Smurf to Seize the Bank Accounts of a Cartel Leader

Sicario, the tense thriller about the drug war between the US and Mexico, Federal Bureau of Investigation (FBI) agent, Kate Macer (Emily Blunt), volunteers to serve as a liaison on an inter-agency task force where the Department of Justice (DOJ) is seeking advisors to focus on cartel activity. Matt Graver, (Josh Brolin) Central Intelligence Agency (CIA), leads a team with the intent of creating chaos within the Sonora cartel based in Juarez, MX.

Graver has several targets in a tiered plan to upset the cartel power balance. His initial target is Manuel Diaz, a businessman in AZ that owns a company that specializes in foreclosure properties along with other legitimate businesses. However, DOJ intel identified Diaz works for the Sonora cartel, is believed to be their most senior member in the US, and the foreclosure properties are used as stash houses in the US. After extracting his brother, Guillermo Diaz, from Juarez to the US in a tense border crossing gunfight, Graver learns of a trafficking tunnel between the US and Mexico. Graver wants to utilize the tunnel with another advisor, a shadowy figure named Alejandro, a former lawyer from Juarez whose family was killed by the Sonora cartel, to enter Mexico undetected.

As part of his chaos plan, Graver goes after Manuel’s money held at a bank in Phoenix, AZ, where he believes freezing Manuel’s accounts will draw him back to Mexico for a meeting with his boss, Fausto Alarcon. At the bank, Graver, Macer, and team watch from a van via the bank’s security camera feed as a smurf deposits rolls of cash into one of Manuel’s accounts. Smurfing is a commonly used method by money launders to place funds into the financial system across multiple banks and/or accounts under the Currency Transaction Reporting (CTR) to avoid detection. CTRs are required to be filed by Bank Secrecy Act (BSA) regulated financial institutions such as banks, money services businesses, etc. for currency transactions of more $10,000 in one direction in one day. The reports are used by law enforcement and tax officials to track fund movements.

Macer, with a high moral compass, enters the bank against Graver’s objection seeking to build a case for indictment of Manuel, talks with the banker and reviews the bank records. The FBI identified that the smurf conducted daily currency transactions of $9,000 into one of Manuel’s accounts. Moreover, Manuel set up a line of credit, for which he overpays the balance, so it appears he is paying back a loan, rather than directly depositing the currency into a deposit account. While the FBI seized $17M and Macer wants to arrest Manuel, Graver reiterates his objective is to get Manuel called back to Mexico. Macer takes issue with Graver because the US has no jurisdiction over Manuel in Mexico. Unbeknownst to Macer, that is exactly Graver’s plan and the reason to find a tunnel: to provide undetected passage for Alejandro to hunt down Manuel and Alarcon in Mexico, where the ‘boundary has been moved.’

Heat (1995)

Botched Armored Car Robbery Nets a Money Launderers Bearer Bonds

Heat, the 170-minute Michael Mann crime drama, features some of the most memorable action sequences in film, a heavy, but methodical opening scene of an armored truck heist gone awry and a chaotic bank robbery shoot-out in downtown Los Angeles, CA. The film maintains multiple storylines, the primary one of cop versus robber with Vincent Hannah (Al Pacino), as the obsessive LAPD Detective, and Neil McCauley (Robert DeNiro), the career criminal taking down scores.

However, an often-overlooked storyline arises out of the opening sequence, where Neil and his crew rob an armored truck that contains cash and bearer bonds, only to leave the cash and take specific bundles of bearer bonds. Bearer bonds are unregistered securities with the ultimate benefit that whomever is in possession of the bonds, owns the assets in the same name, inclusive of any funds in the financial accounts. Pre-know your customer (KYC) days, proving ownership was simply providing the bearer bonds, which unlocked the money in the accounts that may have been funded by a previous owner (or two…or three). The bonds were routinely exchanged among different entities in different jurisdictions to obfuscate the true owner and source of the funds, providing attractive secrecy to illicit financiers for their clients engaged in activity such as narcotics trafficking, political corruption, tax evasion, among others.

At the 13-minute mark, Neil meets with his fence, Nate (Jon Voight), that arranges scores for him, reveals the bearer bonds from the heist are in the name of Malibu Equity & Investments, which is owned by Roger Van Zandt (William Fichtner), a money launderer for drug cartels that owns banks in the Cayman Islands. Nate goes on to tell Neil the bonds are insured and Van Zandt will make 100% of his money back, so they can flip the bonds back to Van Zandt directly, rather than sell them on the market. Neil asks Nate to look into it, while concurrently, Vincent is chasing down the heist crew, which subtly kicks off a series of cat and mouse events for the remaining 157 minutes, including Neil and Vincent having a cup of coffee along the way.

The Night Manager (2016)

Trade-Based Money Laundering Used to Conceal Corrupt Arms Deal

The Night Manager, the six-part espionage series, leads off in Cairo with a former British army soldier, Jonathan Pine (Tom Hiddleston), serving as a luxury hotel night manager. Subsequently, Pine or Jack Lindon or Thomas Quince or, as he is finally known as, Andrew Burch, bounces through Zermatt, Devon, London, Mallorca, Monaco, Marrakech, Istanbul, and the Syrian desert, among others, serving as an informant for Angela Burr (Olivia Colman), an agent for the International Enforcement Agency (IEA) in London, tracking an international arms dealer.

Part revenge story of Pine’s murdered hotel guest, Sophie Alaken (Aure Atika), at the hands of her known arms dealer boyfriend, Freddie Hamid (David Avery), and part stopping the use of military weapons getting into the hands of the wrong people. Pine realizes a central figure in the middle of the murder and the arms deal is Richard Roper (Hugh Laurie), the CEO of Ironlast Limited, which acts as a cover for his back dealing in the arms trade.

In Episode 103, Pine infiltrates Roper’s organization, much to the behest of one of Roper’s close confidants, Lance Corkoran (Tom Hollander). Pine obtains bank statements and incorporation documents from Roper’s private office in the name of Tradepass, which indicate significant purchases for agricultural equipment, code names of persons involved, and two large payments to a ‘Halo’ and a ‘Felix.’

Unbeknownst to Roper that Pine is aware of Tradepass, Roper provides Pine with a new identity, Andrew Burch. Roper assigns 100% of Tradepass to Burch, as the former owner, a Spanish lawyer closer to Roper had been removed from his post, with Pine signing as Burch and Roper having a servant at his home serve as the unknowing witness. Subsequently, in Episode 104, Roper explains his craft on setting up Tradepass as a front company with a strawman, namely, Burch.

A front company is a legal entity that may or may not be engaged in ongoing business activities. In part, the company may be a shell with no real activities or purpose. On the other hand, the company can be engaged in real business activities, however, the illicit activity is commingled behind the scenes, whether physically or digitally.

A strawman, also known as a nominee, is a third party acting on behalf of the owner or controller of an entity. The role of the strawman is to conceal the identity of the actual owner or controller. Here, Roper puts Burch as the face of Tradepass as owner and signing authority, however, Roper is the person running everything for Tradepass. In the scheme, Roper promises his ‘investors’ he has a sharp guy in Burch and he will double their money in four months. He set up Tradepass as a registered company in Cyprus with a bank in Geneva. Roper states “No questions asked, no accounts to be filed.” The investors don’t know what they are selling, they don’t care either, they just care about their money and no one wants to know where the money comes from.

Concurrently, Burr uncovers the identities of Halo and Felix, in a clear government corruption scandal to suppress her investigation, and assists Roper with his arms deal. While Pine, as sole owner of Tradepass and its accounts, diverts the arms sale proceeds ($300M) out of the account and destroys the convoy of arms, leaving Roper with no recourse to the buyer to return the funds or the arms. The buyer is not too pleased, demanding his money back, however, Roper is placed under arrest by Egyptian police…sort of.

Jack Ryan, Season One (2018)

Transaction Analysis Reveals Suspicious Activity of International Wire Transfers Funding a Terrorist Attack

Jack Ryan, the Amazon four-season streaming series that refreshed and repositioned the main character,Dr. Jack Ryan (John Krasinski), as a former battlefield tested marine in Afghanistan turned cubicle-riding Central Intelligence Agency (CIA) threat intelligence analyst in the Terrorist, Finance, and Arms Division (T-FAD). Season One, Episode One, begins with Dr. Ryan at CIA headquarters following the financial trail of someone known as Suleiman.

In a CIA intelligence briefing with the T-FAD team’s new boss, a demoted group chief, James Greer (Wendell Pierce), Dr. Ryan explains that he’s been monitoring SWIFT transactions around Aden, Yemen and has red flagged several transactions as potentially suspicious. SWIFT, which stands for Society for Worldwide Interbank Financial Transactions, is an international messaging network used by financial institutions to wire transfer funds globally. SWIFT relies on a series of message types (MT), which are specific text fields to send a wire transfer from the originator to a beneficiary, inclusive of businesses or individuals. Certain MT fields are mandatory to send the funds, whereas some fields are optional.

Dr. Ryan believes its anomalous to see large one-off transactions to individuals in Yemen, especially with SWIFT, which occur in patterns more typical of frequent business transactions. He further elaborates that he is concerned these transactions are indicative of a high-level target, which he believes to be a man named Suleiman or ‘man of peace.’ Dr. Ryan senses the way people in the region are talking about Suleiman is a cause of concern and that he’s developed a SQL query to run data across two databases, which are not designed to talk to each other, providing him insight into the transactions. Greer remains skeptical of Dr. Ryan’s theory and shuts him down.

At the 17-minute mark, Dr. Ryan follows up with Greer to share the actual details of the red flagged transactions, including transactions executed through a mobile phone-app, which Greer remembers from his time in Karachi, Pakistan. All the transactions are linked to a single account in the name of a Saudi import-export company, which was opened a week and half ago at a bank in Aden. Dr. Ryan independently pulled the business license of the company, which revealed it is less than a month old, leading him to conclude the import-export company is a shell company. A shell company is an incorporated company, like a limited liability company, that lacks significant assets, ongoing business activities, or employees, which can be designed with an ownership that obfuscates the ultimate beneficial owner(s) or controlling person(s). Traditionally, newly formed companies with large transactions are generally considered red flags for suspicious activity.

Dr. Ryan further explains the company executed six SWIFT transactions within eight days totaling more than $9 million dollars, which is inconsistent with the other accounts Dr. Ryan had been monitoring as the largest two transactions barely exceeded $100,000. Dr. Ryan asks Greer to order a demarche, a method for the US to request another government to assist with a legal action in their home country, to freeze the funds on the import-export account. He raises concerns that Suleiman might be ready to execute another 9/11-type event funded with 20x the money it cost Osama Bin Laden to execute the 9/11 attacks. Greer remains unconvinced Dr. Ryan has enough information on the purpose of Suleiman’s funds and denies the request. However, Dr. Ryan finds a way to have the accounts frozen.

Subsequently, in a blend of actionable boots-on-the-ground intelligence meets financial intelligence, two believed-to-be couriers, one a businessman, the other, Soufan, a bodyguard, are picked up in Yemen following a meeting outside a bank by the US Special Activities Division (SAD) and the Yemeni Political Security Organization (PSO). Shortly thereafter, Dr. Ryan’s role is escalated from desk jockey analyst in Washington DC to necessary participant on the ground at a CIA black site in Yemen. Essentially, Dr. Ryan’s intimate knowledge of the financial transactions is sought to help the SAD interrogators with the appropriate questions to ask the couriers seeking information on Suleiman.

At the black site, Dr. Ryan continues to play coy as just an analyst and monitors the courier interrogations. He picks up on that one of the couriers had a mobile phone, intuitively, Dr. Ryan calls the number, and the mobile phone of the businessman rings, which directly links the couriers to the transactions he’s been monitoring. Subsequently, Dr. Ryan engages in a one-on-one interrogation with Soufan, however, based on several visible clues he determines the bodyguard is Suleiman. Concurrently, the site is attacked by a heavily armed local Saudi Arabian militant group seeking to rescue Suleiman, where Dr. Ryan, the ex-marine side, engages in a physical battle with Suleiman. In the end, Suleiman and the militants escape leaving several US soldiers dead, Dr. Ryan confirms the identity of Suleiman, however, he does not obtain any information on what Suleiman is planning.

Subsequently, at a CIA briefing back in Washington DC on the attack, CIA Deputy Director of Operations, Nathan Singer (Timothy Hutton), suggests Suleiman is from the Islamic State of Iraq and Syria aka ISIS in response to a question from the CIA Director of National Intelligence, Bobby Vig (Ron Canada). However, analyst-Dr. Ryan proposes otherwise, which puts Dr. Ryan square in the middle of the briefing to support his dissenting theory. Vig asks why Dr. Ryan knows so much about Suleiman, yet the senior team is only hearing about him for the first time, to which Dr. Ryan states ‘by following the money.’

Dr. Ryan suggests Suleiman does not fit the typical funding profile of ISIS, which uses traditional analog methods such as Hawalas to move funds obtained from smuggling or ceased oil reserves in Iraq and Syria. Hawalas are informal value transfer methods to remit funds, oftentimes, funds are moved in a series of codes through a ledger system to manage the settlement process. Rather, the frozen account was from a European bank that was funded by multiple wire transfers from various fake LLCs with the money ‘washed’ so many times it would be impossible to understand the source of funds.

Unlike ISIS, Dr. Ryan and Greer proffer that Suleiman’s operation is way more sophisticated based on the financial transaction profile and how they coordinated the black site attack. Unfortunately for Dr. Ryan, in a bit of turf war above him between Greer and Singer, the primary intelligence lead is assigned to the European team. However, Greer has Suleiman’s mobile phone that was dropped during the black site attack, but they do not know the passcode to unlock it. From there, the remaining episodes of Season One focus on identifying, locating, and thwarting Suleiman’s terror plot through human and financial intelligence.

Scarface (1983)

Drug Kingpin Places, Layers, and Integrates the Proceeds of Cocaine Sales During Miami’s Drug Wars

Scarface, the crime thriller about a Cuban immigrant turned drug kingpin, provides a glimpse into the 1980’s Miami drug wars. Antonio Montana (aka Tony) arrives in Miami during the Mariel boatlift, the mass exodus of Cuban emigrants from Cuba’s Mariel harbor to Key West, FL, which started in April 1980 and resulted in more than 100,000 Cuban refugees hitting the US shores.

After Tony arrives in the US, he is questioned by US authorities about his criminal past and placed in a refugee detention center known as Freedom Town. From there, Tony is looking for opportunities in the US for money, which leads to power, which leads to women. He agrees to help his friend, Manny Ribera (Steven Bauer), with a paid hit ordered by Omar Suarez (F. Murray Abraham), drug lord Frank Lopez’s (Robert Loggia) confidant, to kill Emilio Rebenga (Roberto Contreras), one of Fidel Castro’s most trusted generals, in exchange for green cards. After the successful hit, Tony and Manny work as a dishwasher and cook at El Paraiso when they are approached by Omar to help with unloading marijuana off a boat.

Tony, the dishwasher, objects to the price Omar offers to unload the boat as too low and feels disrespected after proving his value with the Rebenga hit. After Tony pushes for more money and provides his knowledge on the market price for unloading a boat, Omar gives Tony and Manny an opportunity to work their way up and ‘make big bucks’ by completing a cocaine buy with a bunch of Colombians at a hotel on Ocean Drive in Miami Beach. The buy goes awry with the unequal match of bringing a chainsaw to a machine gun fight.However, Tony and Manny walk away with the 2 kilos of yeyo (aka cocaine) and the original buy money provided by Omar. Tony refuses to give both to Omar, rather, in a power move, he brings both directly to Frank at his home. Thereafter, Frank rewards Tony and Manny with dinner at the Babylon Club, a nightclub that attracts all the drug traffickers, and offers him to help on a future job of using mules coming from Colombia. Mules are persons who act on behalf of another for compensation to move illegal goods, whether drugs or cash derived from drug sales, etc. Omar tells Frank he considers Tony to be a peasant, however, Frank believes he can elevate Tony and he will be loyal as a result.

Subsequently, Tony accompanies Omar, on behalf of Frank, to meet with Alejandro Sosa (Paul Shenar) at his cocaine production facility in Cochabamba, Bolivia. Tony overhears Sosa telling Omar he has an issue with finding a steady buyer for his supply and wants to split the risk. At lunch, Tony starts to negotiate with Sosa on how to be that buyer and share the risk on delivering the cocaine to the US. However, Omar makes Sosa aware he is only authorized by Frank to buy a certain amount and Tony is speaking out of turn. Shortly thereafter, Sosa small talks Omar into heading back to Miami, however, he invites Tony to stick around and talk more business. Unfortunately, Omar does not survive the helicopter flight home as Sosa learned he was a police informant.

Afterwards Tony partners with Sosa directly to take a larger role in the drug trade, he ends up with an abundance of cash as his cocaine business booms. To wit, Tony and his crew walk right into Tri-American City Bank in Miami, FL with several large olive-green military-style duffel bags filled with cash from the cocaine sales. Like many Miami banks at that time, Tri-American City Bank was more than happy to let Tony place his cash at the bank for a healthy fee. Tony also needed businesses and large purchases to layer and integrate his money, so he established several companies in Miami, namely along Brickell Avenue and West Flagler Street, such as Montana Management Co. and Montana Travel Co., funded his sister’s extravagant hair salon, Gina Montana’s Beauty Salon, buys a mansion, hosts his elaborate wedding, and of course, acquires a tiger as a pet.

Eventually, the banker (Dennis Holahan) at Tri-American City Bank has a sit down with Tony at his mansion. A typical business meeting for the time, however, today an established practice under enhanced due diligence (“EDD”) requirements for relationship managers (“RMs”). Under EDD, RMs are required to meet with their high-net-worth private bank clients at their principal place of business and/or residence and document the meetings using call reports to support the ongoing business relationship with the bank.

At the meeting, Tony wants a rate reduction since he is now depositing $10-$15million per month, whereas the banker tells Tony that he needs to raise his rates because Tri-American City Bank is a ‘legitimate bank,’ he needs to offset the risk of taking that much cash, the IRS is coming down heavy, and he alludes to a Time Magazine story on South Florida. (On November 23, 1981, Time Magazine published South Florida: Trouble in Paradise with the cover story headline of Paradise Lost? South Florida). Manny and Tony threaten to move the money to a bank in the Bahamas, however, the banker counters as to whether Tony will trust keeping his money their long term. Rather, Tony should stay with Tri-American City Bank as an ‘old and well-liked customer’ and ‘he is in good hands with us.’

Interestingly, in the early 1980’s, money laundering was not a US federal crime. While the Bank Secrecy Act (BSA), which was established in 1970, created recordkeeping requirements for financial institutions and currency transaction reporting (CTR) requirements for cash transactions more than $10,000 in a single day, state and federal law enforcement were understaffed and lacked training in following the money. At that time, enforcement of the BSA by the banking regulators was non-existent and the banks rarely complied with CTR reporting, arguing that such reporting and inquiring into customers was the job of law enforcement. Moreover, the onslaught of cocaine and marijuana purchased with cash and the international nature of drug trafficking and financial movements overwhelmed the US banking system during the US savings and loan (S&L) crisis with record high inflation rates between 14-20%.

In response to significant illicit finance and weak federal laws, the US passed the Money Laundering Control Act of 1986, which included the very powerful Title 18 USC §1956 and 18 USC §1957 that prohibit knowingly engaging in financial transactions using funds derived from a specified unlawful activity (SUA). More specifically, §1956 generally, investigations do not require a dollar amount limit and do not require that a financial institution be involved. Whereas §1957 prohibits monetary transactions over $10,000 or an aggregate of money transactions over $10,000 of criminally derived funds obtained from a SUA while utilizing a financial institution. Today, most federal money laundering investigations charge the defendant(s) with violating §1956 and/or §1957.

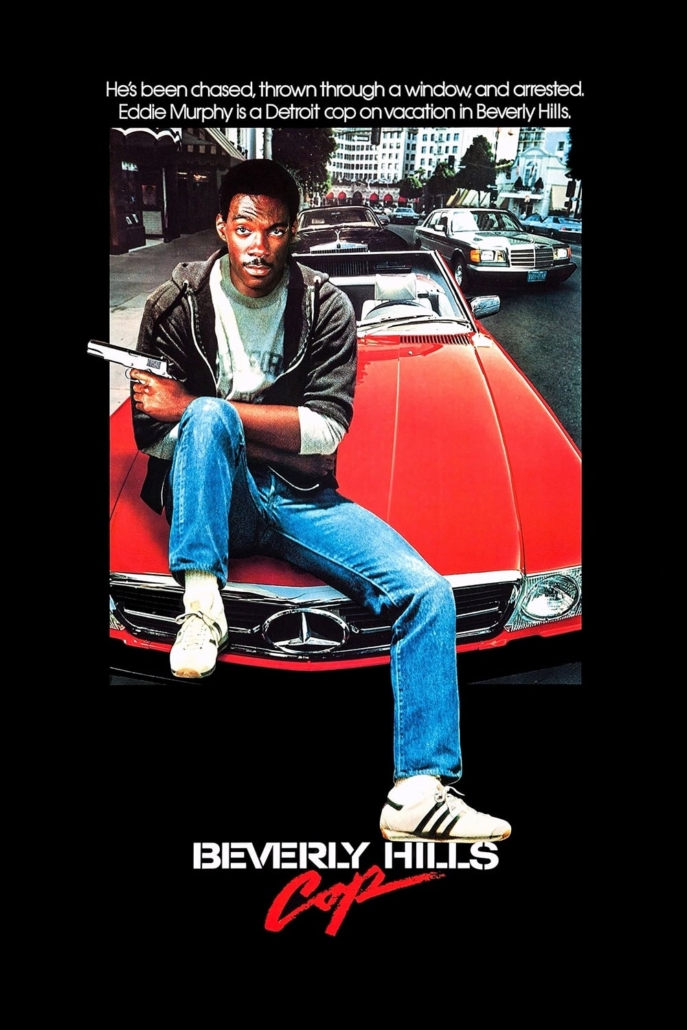

Beverly Hills Cop (1984)

Important Local Businessman uses his Art Gallery as a Front Company for Drug Smuggling

Beverly Hills Cop, the 1980’s action-comedy about Axel Foley (Eddie Murphy), the hot shot detective from the Detroit Police Department, that goes on ‘vacation’ to Beverly Hills to investigate the murder of his childhood friend, Michael Tandino (James Russo). After Tandino breaks into Axel’s apartment in Detroit, he tells Axel he was released early from prison and went to California. Tandino pulls out $10,000 Deutsch Marks in bearer bonds from a brown paper bag, calls them ‘untraceable,’ then when asked by Axel whether he stole them, Tandino responds with a blank stare.

Bearer bonds are unregistered securities with the ultimate benefit that whoever is in possession of the bonds, owns the assets in the same name, inclusive of any funds in the financial accounts. Pre-know your customer (KYC) days, proving ownership was simply providing the bearer bonds, which unlocked the money in the accounts that may have been funded by a previous owner (or two…or three). The bonds were routinely exchanged among different entities in different jurisdictions to obfuscate the true owner and source of the funds, providing attractive secrecy to illicit financiers for their clients engaged in activity such as narcotics trafficking, political corruption, tax evasion, among others.

Shortly thereafter, Tandino tells Axel, in which Axel laughs while shooting a game of billiards, that their childhood friend, Jenny Summers, got him a job as a security guard at the world famous Hollis Benton Art Gallery in Beverly Hills. Subsequently, Tandino is murdered outside Axel’s apartment because of the stolen bearer bonds, which Axel’s boss, Inspector Todd (Gilbert R. Hill), believes Tandino’s murder was a professional hit. In response, Axel volunteers to go on vacation as Todd tells him to stay away from the Tandino murder case. However, in typical Axel fashion, he drives his crappy blue Chevy Nova right through the glitz and glamour of Beverly Hills to meet up with some old friends, gets acquainted with a different way of life, and learns the ways of the ‘by the book’ Beverly Hills Police Department (BHPD).

In Beverly Hills, Axel continues to size up his new environment and visits the art gallery where Summers works, he observes an interesting art piece, and learns from Serge (Bronson Pinchot) that a collector paid $130,000 USD (approximately $400,00 USD today) for the same piece yesterday. Summers shares that gallery owner, Victor Maitland, hired Tandino as a favor and he worked at Maitland’s warehouse. Axel visits Maitland at his office uninvited, gets thrown out of a window, and is arrested by the BHPD. At BHPD headquarters, Sergeant Taggart (John Ashton) doubts Axel’s version of his story of the events and scolds Axel that he would believe the word of an ‘important local businessman,’ Victor Maitland, that Axel broke in to his office, tore up the place, and jumped out the window on his own.

In the US, the art industry is not covered under the Bank Secrecy Act (BSA), however, like any transaction involving a US person, art transactions are subject to the Office of Foreign Assets Control (OFAC) sanctions requirements. Art dealers or advisors are not subject to anti-money laundering (AML) requirements yet may self-regulate their own participation in the art transaction process out of comfort on the buyer or seller or both. Due to the high value of the goods and malleable intrinsic value of art, art transactions are largely considered private transactions. Moreover, KYC, inclusive of beneficial ownership information on private company transactions, is voluntary.

Under the Anti-Money Laundering Act of 2020 (AML Act), Section 6110(c), the US sought to amend the BSA to include persons engaged in the trade of antiquities. However, a 2022 study performed by the US Treasury concluded there were higher priorities to close the gaps on BSA/AML laws such as the real estate sector, rather than regulate the art industry. Globally, new laws and guidance continue to be issued on the art world such as the 5AMLD in the European Union, inclusive of the UK, effective January 10, 2020, that imposes AML requirements on persons engaged in art transactions EUR 10,000 or more, HMRC registration in the UK for art market participants with approved HM Treasury guidance from the British Art Market Federation, and global guidance in 2023 from Financial Action Task Force (FATF), among others.

After Axel puts a banana in the tailpipe of a BHPD undercover car during a late-night supper, Axel and Summers go to Maitland’s warehouse, where Axel observes open shipping crates stamped ‘HOLLIS BENTON’ with coffee grounds spread around. He explains to Summers that coffee grounds are used by smugglers to disguise the drug scent from the sniffer dogs. The crates are opened by two guys that appear to be customs workers, and stacks of bearer bonds are removed from the crates. Thereafter, the crates are resealed and returned to a bonded warehouse near the Los Angeles airport, where Maitland’s foreign shipments are held before they clear customs.

Ever inquisitive, Axel visits Maitland at his posh members-only club, the Harrow Club, and confronts him again about killing Tandino, only to find himself back at BHPD headquarters. He eventually tells Lieutenant Bogomil that Maitland is a smuggler of bonds, drugs, etc. In essence, the art gallery is a front company, and, in a form of corruption, Maitland pays off customs agents, the crates containing drugs and bearer bonds are temporarily diverted from the bonded warehouse, the contraband removed at Maitland’s warehouse, and the crates are returned to the bonded warehouse. A front company is a legal entity that may or may not be engaged in ongoing business activities. In part, the company may be a shell with no real activities or purpose. On the other hand, the company can be engaged in real business activities, however, the illicit activity is commingled behind the scenes, whether physically or digitally. Here, Maitland is using the art gallery as a front for his drug smuggling operation.

Based on Axel’s latest incident, Bogomil instructs Detective Billy Rosewood to take Axel to the city limits. However, Axel convinces Rosewood and Summers that based on shipping documents, another shipment was inbound that day, i.e. the shipping crates containing the contraband would be unloaded at Maitland’s warehouse and to go there to prove it. Axel’s hunch was correct as he sees the open shipping crates and confirms the coffee grounds are being used to mask kilos of cocaine. The action revs up as Maitland confronts Axel, Rosewood starts a gun fight, which continues and ends at Maitland’s mansion at 509 Palm Canyon Road.

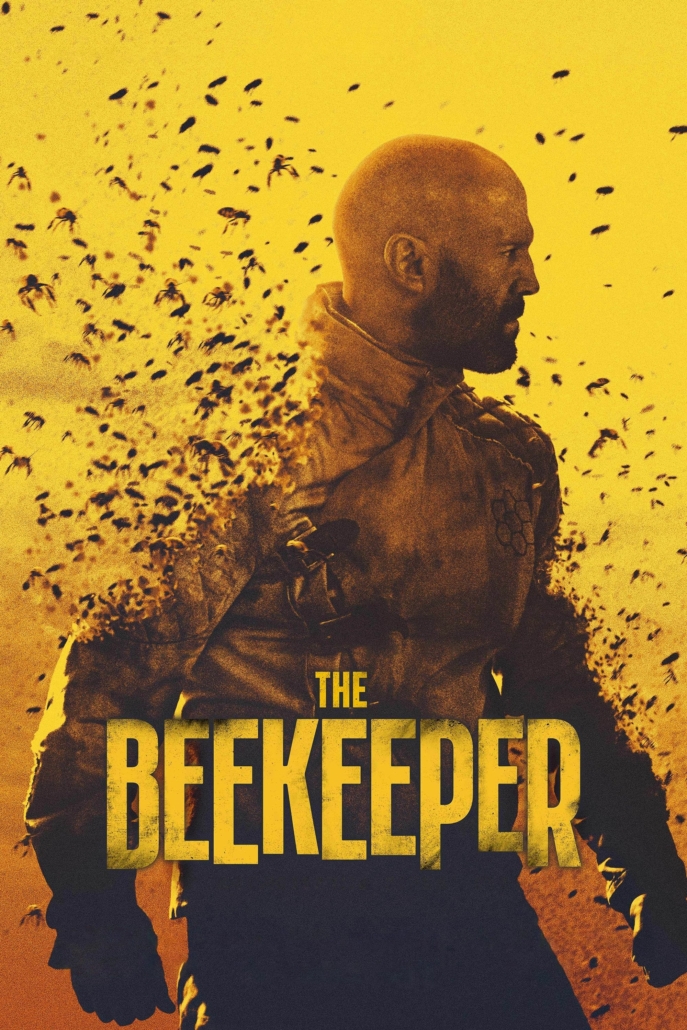

The Beekeeper (2024)

Large-Scale Tech Support Scam Disguised as a Call Center Preys on Elderly Victims to Fund a Presidential Campaign

The Beekeeper, the crime thriller about a former US government operative known as a Beekeeper now living the quiet life uncovers a fraud scheme that funded a presidential campaign. Adam Clay (Jason Statham), a former Beekeeper, now raises bees on a remote farm property in Springfield, Massachusetts owned by a retired educator, Eloise Parker (Phylicia Rishad).

In the opening scene, Ms. Parker accesses her laptop to perform her daily accounting activities when the computer screen prompts a warning notice that her hard drive has been infected with a virus and to call an 800 number immediately to ensure she does not lose her data. As Ms. Parker gets frustrated, she calls the number and is connected to a ‘Boyd’ at United Data Group. Unbeknownst to Ms. Parker, Boyd is really Mickey Garnett (David Witts) running a boiler room-style ‘call center’ focusing on stealing people’s money with a well-coordinated tech support scam. A tech support scam preys on the victim to trick them into believing the company is trying to help fix the virus issue, however, the scam is to remote desktop into the victim’s computer to access any and all information, including bank account details.

As Ms. Parker talks with Boyd, he expresses empathy with her about the situation and then engages in familiarity with the issue that the virus shield software was already pre-installed on her laptop and how she can fix it. However, the fix is complicated, requires physical travel, and threatens to delete all Ms. Parker’s data. As such, she agrees with Boyd’s suggestion to help as he can fix the problem remotely by steering her to ‘friendlyfriend.net,’ which features a legitimate looking homepage stating, ‘A Remote Desktop Solution That Makes Sense.’ Ms. Parker follows along to download the software to reinstall the virus shield, which is really providing remote access to her computer for his boiler-room team. Unfortunately, according to the FBI, the elderly are prime targets for tech support scams due to their increased age, lack of tech savvy, and the embarrassment of losing their data.

As Boyd keeps Ms. Parker on the line, the team combs through her accounts to identify she has $10k in checking, a life insurance annuity, a teacher’s pension, and that she is a signatory on a charity with an account balance of more than $2M. Boyd is elated and calls out to the boiler-room team to ‘let the strip mining begin.’ Subsequently, the team starts to overwhelm Ms. Parker with various windows opening and closing where she believes her computer is going ‘crazy.’ Again, Boyd expresses empathy and due to the inconvenience of this whole situation, he is going to credit back to Ms. Parker the subscription fees. Here, as part of the scam, the victim is overwhelmed and does not even realize they were never paying any subscription fee, however, the credit keeps the hook going to get her computer working normally.

To subvert Ms. Parker, Boyd states he’s going to credit her back $500 to her bank account ending ‘2020’ – the account of the charity with the $2M balance. Ms. Parker admits that is not her account, rather an account she manages, and she follows Boyd’s instructions to log into the charity account to verify the transfer. Now, much to her surprise, Ms. Parker sees a $50,000 transfer in the charity account, to which Boyd admits he made a huge mistake and he’s going to lose his job. Ms. Parker responds that she can send him back the money with a wire transfer, however, she will need to use a different password, which is ultimately the master password across all her accounts. Bank credentials are a key part of any scam.

She begins to doubt herself and believes its best to call the bank to confirm, however, Boyd applies subtle pressure that he is going to lose his job, and Ms. Parker is going to lose all her data, including all her cherished family photos. Once she enters the password, her computer screen goes blank and the phone call cuts, the video board in the boiler-room shows zero balances across all her accounts, and Boyd cheers Wolf of Wall Street-style on his theft. Once Ms. Parker’s computer comes back to life, she sees the zero balances and receives text message alerts on her mobile phone alerting to possible fraud on her accounts. She realizes she’s been scammed and lost all the money in her accounts.

That same night, Clay heads up to Ms. Parker’s house with some freshly jarred honey, where he notices that Ms. Parker committed suicide. While Ms. Parker’s daughter, an FBI agent, is initially suspicious of Clay, she realizes her mother was scammed, however, her contacts at the FBI cybercrimes revealed the fraud ring has been running for two years and they have no identities of the perpetrators. From there, Clay, the Beekeeper, goes all Transporter-like to reveal that the call center operation is the most profitable part of United Data Group, which is run by the youngish heir to a family fortune, and he uses the call center funds to fund his mother’s presidential election campaign.

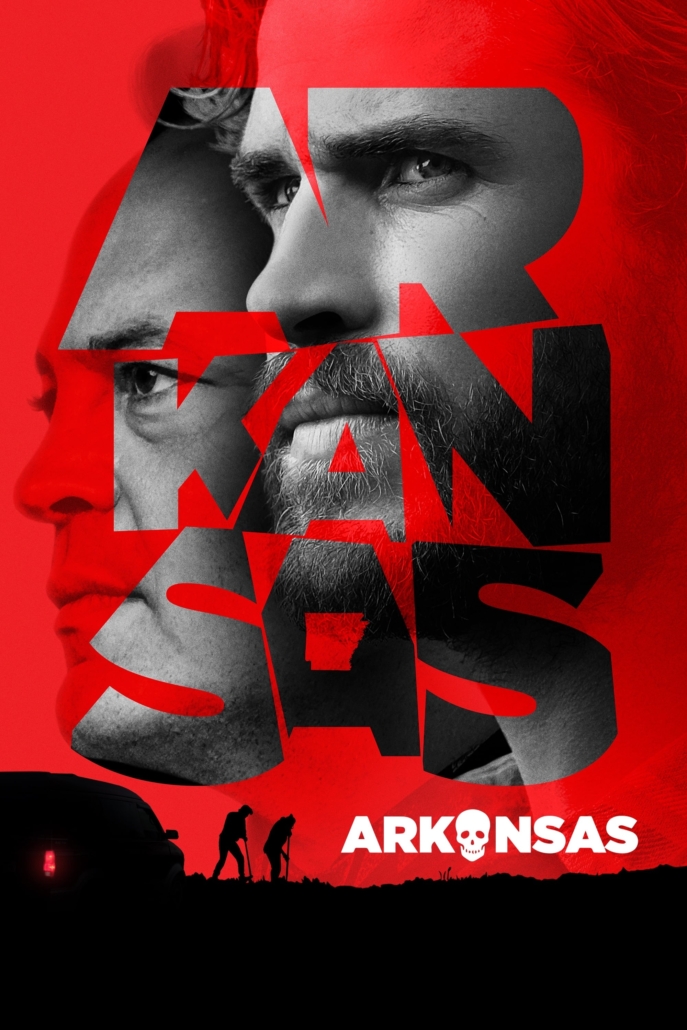

Arkansas (2020)

Bayou Drug Dealer uses Front Businesses to Disguise his Drug Operation, While a Close Associate Withdraws all the Proceeds from their Joint Bank Account

Arkansas, is a southern noir-crime thriller about two low level drug dealers working for a drug kingpin they never met before. Kyle Ribb (Liam Hemsworth), a local drug dealer and courier gets promoted to run an operation in Little Rock, Arkansas. Klye self identifies he’s at the bottom of an organized crime outfit run by an elusive guy named Frog. He moves in and out of random phone booths, bathrooms, laundromats, moving his product. Kyle believes the ‘Dixie Mafia’ in the south is overplayed and organized crime is not that organized, rather, just a lose affiliation of deadbeats with no code of honor, yet he sees it as mostly boring and solitary work.

Kyle partners up with a wise guy named Swin Horn (Clarke Duke) to transport drugs from Little Rock to Corpus Christi, Texas. The two drive a commercial flatbed pickup truck stacked with visible cardboard boxes containing the contraband. After one of the ties on the cover breaks along the highway, they stop to repair the ties, only to be confronted by the local Park Ranger, Pat Bright (John Malkovich). Bright inspects the truck and questions Swin about this tie down skills, but also the unusually large volume of kitchen faucets as cargo.

Bright tells the two that he works with Frog and there is a change of plans as Frog is running a new operation through the park. As such, Kyle and Swin are seconded to living and working at the park under assumed identities supporting their new boss, Bright. Initially, Kyle and Swin believe Bright is truly Frog, but feel it is going to be a long time before they ever meet the real Frog. In the interim, they traffic Frog’s (and Bright’s) drugs across state lines to Alabama and Louisiana. However, one deal goes sideways with Bright getting killed. Kyle and Swin continue their drug dealing operation, however, they hold onto the money in a washing machine waiting for Frog to show up.

Unbeknownst to both, Frog uses a series of pawn shops as front companies where he advertises, he ‘buys and sells anything,’ but does not sell anything. Previously, Frog brought on two teenagers (Tim and Thomas) to help run his operation and they used a donut shop as their front company. The two teenagers, later as adults, are sent by Frog to kill Kyle and Swin because of the loose ends from Bright’s park operation. However, the attack is botched with Swin getting killed and Tim seriously injured.

In the end, Frog visits his accountant to wrap things up financially only to learn Thomas sold everything, cashed out all the accounts, stocks, bonds, etc. The accountant tells Frog this is the danger of joint bank accounts in that you can never be sure of what is going on in another person’s mind. In the US, a joint account is an account co-owned by two natural persons that provides equal ownership to the account. The danger of joint accounts, whether by marriage, parent/child, partners, friends, close associates, etc. is one person can unilaterally act on the account without the permission of the co-owner as both persons named on the account have equal rights to the contents of the account. With Frog having no money and people, he starts to set up shop again.

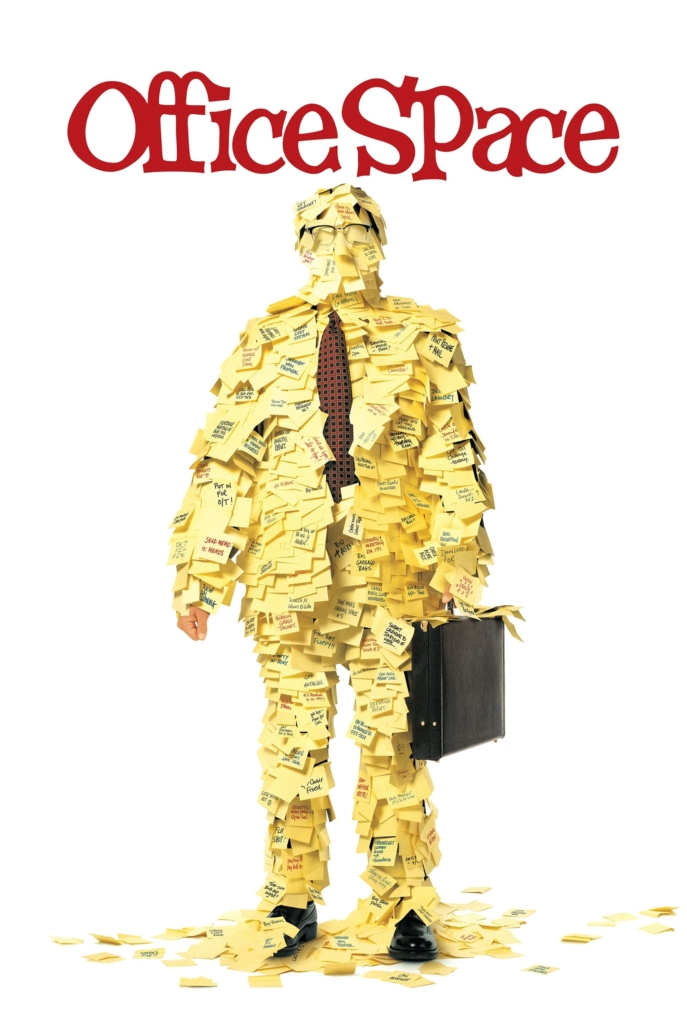

Office Space (1999)

Disenchanted Employees Install a Computer Virus on their Employer’s Systems to Steal Company Funds, then Need to Launder the Ill-Gotten Gains

Office Space, the comedy about TPS reports, fax machines, answering machines, floppy disks, PC load letter, Hawaiian shirt day, 15 pieces of flair, snarling commutes, office cubicles, tips jars vs. trays, and a group of friends that skim off their hated employer to end the monotony of it all. In the Y2K era, where the computer-based world was supposed to end because of using two-digit year codes, Initech employees Peter Gibbons (Ron Livingston), Samir Nagheenanajar (Ajay Naidu), and Michael Bolton (David Herman) [not that Michael Bolton…] are software engineers plugging away at lines of code to update bank software for the Y2K switch.

After Michael and Samir learn from Peter they are going to be laid off by efficiency consultants, the three plan to strike back at Initech by installing a virus into the credit union’s mainframe and the rest will take care of itself. The plan was for the virus to take a fraction of a cent on thousands of transactions over several years, which the three felt would be undetected, but would net them several hundred thousand dollars. Michael explained to Peter that Initech was so backed up with Y2K software updates it would be unlikely they would notice the virus impacted the code.

Unfortunately, the plan goes sideways with the more than $305,000 deposited into Peter’s account, which he recently opened for this specific purpose. A notable red flag for unusual activity on customer accounts is when significant funds are deposited into newly opened accounts. The three are very concerned about the acceleration of the skimming with Peter asking Michael how it happened. Michael believes he put the decimal point in the wrong place since he usually always screws up mundane details. Peter disagrees that $305,326.13 is a mundane detail and corporate accounting is going to notice the funds being gone. Moreover, Peter believes he should close the account before the amount gets bigger, again, another red flag.

Subsequently, the three try to solve what to do with their ill-gotten gains such as hand the money back for the amount missing or try to launder the money using a cocaine dealer. However, the three do not understand the definition of money laundering, so they look it up in a dictionary, to which Michael states, “to conceal the source of money by channeling it through an intermediary.” They come across a potential solution to their money laundering problem when a former crack addict door-to-door salesman seeks to sell them magazine subscriptions. As the three are so desperate, they think the salesman knows a crack dealer and can introduce them to one. However, the salesman was really an unemployed engineer from an Initech competitor and to stay quiet about their story, Peter buys 40 magazine subscriptions. As such, the three fear what type of prison they will go to for laundering money, which does not include white-collar resort prison.

Peter has regrets about stealing the money, decides he should return it by leaving a confession under his boss’s door late at night. The next day, as Peter heads to work to face the consequences of his actions, he arrives at Initech’s office building engulfed in flames, which consumed his confession letter to his boss. Peter laughs it off as earlier in the movie his co-worker Milton told him that if Initech took his stapler, then he would set the building on fire. Eventually, Peter moves on from office work into construction, Samir and Michael continue at another software company, and Milton sips margaritas from an island resort.

To close, when you are just having one of those days at the office let it out or call it a day.

Jack Ryan: Shadow Recruit (2014)

Compliance Officer Identifies Unusual Trade Activity of an Important Client from a High-Risk Country Indicating a Possible Terror Plot

Jack Ryan: Shadow Recruit, the post- 9/11 espionage thriller that updated the focus of Jack Ryan to thwarting terrorist plots on US soil steeped in manipulating global financial markets. Post-Afghanistan battlefield injured-Marine, Jack Ryan (Chris Pine), encounters William Harper (Kevin Costner) while in recovery at a Washington D.C. hospital. Harper is impressed with Ryan based on his military background and seeks to recruit him to the Central Intelligence Agency (CIA) by offering him a cozy desk job as a covert analyst at Wall Street private banks to track terror groups.

To execute, Jack needs a role that provides him access to enterprise-wide client and financial data to identify and detect unusual activities indicative of terrorist financing. Enter the most over-educated compliance officer in finance: Jack Ryan, PhD of Harrman Brothers (Harrman), a Wall Street investment bank.

As a matter of best practice to manage a risk-based compliance program of a financial institution, a compliance officer needs to maintain an awareness of geopolitical events that may impact the financial institution and its customer base. While Jack is serving as the covert compliance officer at Harrman, political gamesmanship is afoot between the United Nations (UN), US, Russia, and Turkey. Namely, Russia opposes the development of a pipeline across Turkey because it would impact Russia’s dominance on oil exports, a key economic engine for the nation.

At the UN, a US representative informs a Russian representative that the US denied Russia’s proposal to block the pipeline. The Russian countered that this matter is now an economic war due to the foreseeable negative impact on Russian oil exports. Back at Harrman, Jack is aware of the television commentary covering the pipeline saga and its impact on global currency prices. While keeping up to date on the markets, Jack is reviewing the trading activity of a firm client, Cherevin, owned by Viktor Cherevin (Kenneth Branagh), a Russian oligarch, on a compliance officer/analyst’s favorite technical friend: an Excel spreadsheet. As Jack seeks to gather additional information supporting the trades, his access to the files is denied.

To push forward on some suspicions, Jack seeks to meet covertly with Harper at a movie theater showing, Sorry, Wrong Number. At the theater, Jack passes across a file to a CIA colleague on Cherevin and says they need to visit Russia. The colleague informs Jack that no one understands the financial data and he needs to find a way to Russia to investigate further. Enter the most unassuming way a compliance officer can learn about a high-risk client: The site visit or audit.

However, Jack needs to convince his boss at Harrman, Rob Behringer (Colm Feore), to visit Cherevin Group in Moscow due to unnamed accounts, uncategorized transaction spread all over the world with Cherevin Group and Khorobask Holdings in Russia. Rob asks Jack how he found the transactions, to which Jack replies, “you pay me to look,” with Rob countering, “not to look that hard.” Rob takes the business approach and questions Jack on whether Cherevin is stealing from Harrman. He also defers to Jack as the compliance officer with a kind reminder to not screw up Harrman’s most lucrative partnership “Don’t rock the boat, it’s a luxury yacht and we are all on it together, so don’t sink us.”

Separately, the pipeline issue heats up and Russia moves towards a coordinated attack on the US led by Cherevin’s son. Cherevin met with Russian Interior Minister, Sergey Sorokin (Mikhail Baryshnikov), and Cherevin confirmed he started to move financial assets based on the UN vote to undermine the US economy. Critically, Sorokin makes it clear to Cherevin that the Kremlin must be distanced from Cherevin’s financial market moves.

Post 9/11, under the USA PATRIOT Act of 2001, the US introduced significant legislation to protect the US financial system by enhancing compliance, reporting, information sharing, and due diligence requirements, among others, of domestic and foreign financial institutions. Moreover, the Act included specific requirements for private banking accounts and politically exposed persons (under the Act known as senior foreign political officials).

Under the Section 312 of the USA PATRIOT Act, private banking account is an account that is established or maintained for the benefit of one or more non-U.S. persons, requires a minimum aggregate deposit of funds or other assets of not less than $1,000,000, and is assigned to a bank employee who is a liaison between the financial institution and the non-U.S. person. If an account otherwise satisfies the definition of a private banking account, but the financial institution does not require a minimum balance of $1,000,000, then the account does not qualify as a private banking account.

While the Financial Action Task Force (FATF) under Recommendation 12 considers a politically exposed person (PEP) an individual who is or has been entrusted with a prominent public function, whether domestic or foreign, the US does not maintain a broad-based PEP law. Rather, under Section 312 of the USA PATRIOT Act, a senior foreign political figure is considered a current or former senior official in the executive, legislative, administrative, military, or judicial branches of a foreign government, whether or not they are or were elected officials; a senior official of a major foreign political party; and a senior executive of a foreign government-owned commercial enterprise. This definition also includes a corporation, business, or other entity formed by or for the benefit of such an individual. Senior executives are individuals with substantial authority over policy, operations, or the use of government-owned resources. Moreover, a senior foreign political figure includes immediate family members of such individuals, and those who are widely and publicly known (or actually known) close associates of a senior foreign political figure.

Interestingly, allegedly unbeknownst to Harrman until Jack Ryan looks, Cherevin operates as an extension of the Russian government, which would include Section 312 requirements. Back in the US, Jack’s girlfriend, Cathy Muller (Keira Knightley), discovers he went to see Sorry, Wrong Number without her as they previously discussed going together over dinner. When questioned about who he went to the movie with while insinuating an affair, Jack responded by himself, “he’s a compliance officer and does everything by himself.”

Jack heads off to Russia and is picked up at the airport by Cherevin’s driver. Unfortunately for Jack, the driver is sent by Cherevin to kill him with Jack relying on his military training to defeat the attack. Jack connects with CIA operations stating he is just an analyst and needs help. Jack is reminded he is actually a Marine and needs to meet with Harper in Staraya Square, which is adjacent to the Russian Presidential Administration building.

At the meeting with Harper, Jack reveals Cherevin’s plans as he noticed a series of undisclosed Cherevin accounts at Harrman with massive currency positions in US treasuries, indicative of Cherevin making a total commitment to the US dollar when the US experienced a number of natural events, which is known as external sterilized intervention, i.e. the US dollar should go down based on the events, however, it crept up, a few cents each day. Jack believes Cherevin is propping up Wall Street in a Russian government-sponsored coordinated plot to collapse the US dollar and crash the US economy with a follow-on terrorist attack on US soil. Russia intends massive US dollar sales prompting the rest of the world to dump the same. The key is Russia will recover from the market crash because they have the oil reserves, whereas the US does not, which will result in the Second Great Depression.

Jack surmises that the massive trades must be pre-programmed in advance to ensure coordination across the markets and are most likely stored in Cherevin’s systems. Jack believes the audit can be used to understand the date and time of the attack down to the minute with Harper agreeing to proceed with the audit. Jack tells Harper that he sold him on an office job, Harper hands Jack a firearm and reminds him he is no longer an analyst, he’s operational.

Jack proceeds to Cherevin’s Moscow office to conduct the routine audit, then off to dinner with Cherevin as cover to undermine the pre-programmed market sell, which results in Cathy getting kidnapped as leverage by Cherevin, and the terrorist sleeper cell is activated in the US to coordinate the ground attack. In the end, no-longer-a-compliance-officer operational Jack thwarts the terrorist attack in New York.

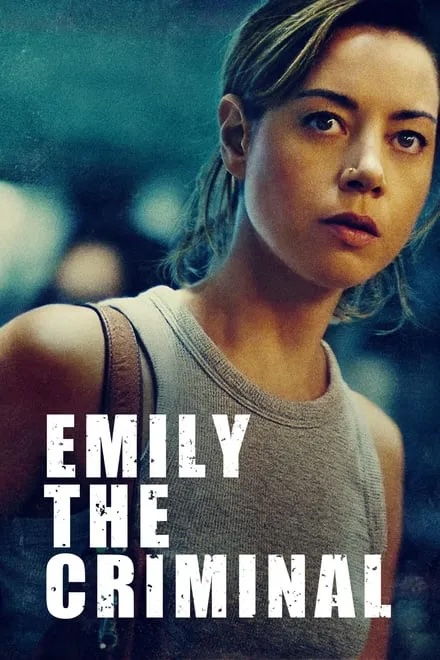

Emily the Criminal (2022)

Dummy Shopper Credit Card Scam Operator Dreams of Integrating Proceeds into a Large Real Estate Purchase

Emily the Criminal, the noir-crime thriller about a woman struggling with student and credit card debt enters the world of credit card fraud for some quick money. Emily Benetto (Aubrey Plaza) is saddled with more than $70,000 of student debt and is working at a catering company while she looks for a ‘real’ job. Unfortunately, she has a criminal background of a prior assault and driving under the influence, which is an impediment to her during job interviews.

While at the catering company, Emily prepares and delivers meals for catered luncheons and business meetings at corporate offices, feeling the pressure of where she is at in life as the meeting attendees look down at her delivery mistakes. Post-delivery, Emily agrees to help a catering colleague by filling in for him as a dummy shopper to make $200. A dummy or mystery shopper is a fraud scam that involves a person being paid to shop for goods or prepaid cards using fraudulent means, such as stolen identities added to credit cards or debit cards.

Fraudsters use multiple methods to steal credit and debit card information such as random access memory (RAM) scraping using installed malware on point of sale terminals, skimming using a device installed on point of sale or automated teller machines, email spoofing a victim to reveal sensitive information by simple changes to email senders, websites, etc., and phishing scams that seek to appear like a legit business or communication only to trick the recipient into sharing sensitive information to a hacked or fake website.

For the dummy shopper job Emily shows up at a vacant storefront, which is an old laundry facility, and heads to the back where a group of people are sitting awaiting instructions. The leader, Youcef Haddad (Theo Rossi), informs the attendees they will be paid $200 cash, but each must do something illegal to be paid. After they agree, each attendee receives a credit card with stolen details, a matching driver’s license, and are instructed to buy a flat screen television from a local retailer for $1,999.99. Emily completes the task with no issues, delivers the television to a white commercial van in the parking lot. Once inside the van, Youcef offers Emily a bigger job for $2,000 cash.

The next job requires Emily to use of an American Express Black Card, which maintains no credit limit, and a cashier’s check, which are financial institution-issued checks that represent good funds to the payee. The two instruments would be used on a split purchase to buy a BMW from an independent dealer. A common fraud mitigant is a callback to verify the purchaser on credit card transactions or to verify the authenticity of the cashier’s check by contacting the issuing financial institution.

Based on the purchase size, Youcef informs Emily the credit card company will call the seller to verify the credit card purchase, and she has eight (8) minutes to leave. Beyond eight (8) minutes, she runs the risk of being exposed. After the purchase, when getting into the BMW, the seller realizes the potential fraud, then seeks to remove Emily from the car, breaking her nose. She races off with the car; the seller chases her in another car and cuts her off; he gets out and approaches Emily only to be sprayed with pepper spray. Bleeding and busted up, Emily returns the car to Youcef, where she gets paid $2,000 cash.

As Youcef seeks to impress Emily, he reveals to her he wants to use his money to buy a 40-unit apartment building with the intent to fix up the units and rent them. Emily is intrigued and curious as to how much money Youcef makes to be able to afford such an expensive purchase. Real estate purchases are a common form of integration, which is the third stage of money laundering, whereby the illicitly obtained funds are integrated back into society without detection from its origin.

After the car heist, Emily remains disenfranchised with her catering job as her boss removed her from the upcoming schedule – she did not show up as she was performing the car heist – and reminds her she is an independent contractor, not a unionized worker with job protections. Desperate, Youcef shows her how to ‘card’ – creating physical credit cards with stolen names using a card embossing machine; then scans the credit card chip with a magnet, which transfers the stolen data to the newly minted credit card.

After her initial taste of carding, Emily goes all in on a life of crime: Youcef gives her the card machine embosser, a stun gun, and a box of blank cards. She steals more TVs, then resells them online with meeting the buyer in a public space. However, Emily gets hustled by the buyer when he renegotiates the price from $600 to $300 cash. Emily kills the deal, threatens to walk away, but then the buyer agrees to the $600, then he asks Emily what else she has? Emily gets hooked. She starts to sell a bunch of fraudulently obtained products to the same buyer.

As Emily and Youcef get closer, Khalil (Jonathan Avigdori), Youcef’s brother, does not trust Emily believing she would expose their operation. As a result, Khalil double-crosses Youcef by taking all the money leading in the end to a physical altercation between Youcef, Khalil, and Emily.

Equalizer 3 (2023)

Change in Historical Transactional Behavior of a Winery Raises Suspicion of Illicit Activity

In Equalizer 3, Robert McCall (Denzel Washington), a former Central Intelligence Agency (CIA) operative, is just a guy passing through and drinking tea in a scenic town in Sicily, Italy. McCall finds himself in Italy because he tracked down a cyber attacker that hacked the pension fund of a bricklayer’s union in Boston, MA with a member losing his entire savings of $366,400.

As in all the prior Equalizer movies in the three-part series, it does not take long for McCall to bring the terror. He travels to the Cantina Arriana Vineyard just south of Palermo, which is owned by Lorenzo Vitale (Bruno Bilotta), an alleged Sicilian farmer, who appeared on Interpol’s most wanted list for more than a decade because he ran a cyber hacking empire, to start the body count and retrieve the stolen funds.

After McCall’s visit to the Vineyard, he places an anonymous call to Emma Collins (Dakota Fanning), a CIA agent in the CIA Financial Operations Group responsible for tracking suspect money sources, identifying the Vineyard imported 55 crates of wine from Syria, which he thought was odd that a winery in Sicily would be importing wine from Syria. He informs Collins that he suspects a repackaging operation and suggests the CIA send in a physical access team.

The CIA and local Italian police raid the winery and find dead bodies, bags of phenylephrine hydrochloride tablets, an amphetamine, stuffed inside wine bottles, and $11M USD in cash. Collins refers to the hydrochloride as an ISIS jihad drug for Syrian terrorists. Her boss, Frank Conroy (David Denman), is very concerned about being blind to a terrorist cell and missing an attack, less concerned about the money, which he speculates is related to money laundering or cyber theft, and not their immediate problem.

As a good investigative analyst, Collins proactively reviewed the financials of the Vineyard and identified the crates were the fourth shipment as she noticed an increase in shipments from the Vineyard. Historically and over the past 18 months, the Vineyard shipped 200 cases of wine per month, however, the last four shipments were increased to 500 cases of wine per month. A significant deviation in business activity is a common money laundering red flag.

As noted by Collins, the increase in shipments would impact the Vineyard’s bills of lading, but also their financials by 2.5 times. Oftentimes, traffickers use established clean businesses for trade-based money laundering schemes to limit detection of passing through the illicit activity as an increase in sales. Absent reasonable justification and documentation to support the increase, the financial institution maintaining the accounts of the Vineyard would most likely file a suspicious transaction (or activity) report with the country’s financial intelligence unit (FIU). For example, in Italy, the Unità Di Informazione Finanziaria (UIF) serves as the FIU and is the recipient of electronically filed suspicious transaction reports (STRs) through the Bank of Italy’s dedicated INFOSTAT-UIF portal.

After Collins approaches McCall at a café in town, Collins and McCall play a CIA cat and mouse game on why he was at the Vineyard. Later, McCall informs Collins that the locals have their own agenda as McCall questions why one would smuggle drugs into the most secure port in the entire region inferring something larger is afoot. After witnessing some bloodshed in town against the local townspeople, McCall believes the Camorra, the Italian mafia, are running the operation. McCall sympathizes with the townspeople and decides to publicly show the Camorra how he feels while enjoying his dinner. Concurrently, Collins learns the local police chief is in the pocket of the Camorra when she is denied local assistance talking to certain prisoners with intelligence on the local drug smuggling.

To take back the town, McCall confronts Vincent Quaranta (Andrea Scarduzio), the local Camorra boss, in the town square amongst the townspeople with camera phones recording Quaranta preparing to shoot McCall. Concerned about the filming, the Camorra flee to Quaranta’s mansion only to be finished off by McCall.

In the end, McCall returns peace to the town by eradicating the Camorra and he explains to Collins the reason he wanted to retrieve the $366,400.

415.352.1060 2193 Fillmore Street, Suite 1

San Francisco, CA 94115

RISK | STRATEGY | CYBER COMPLIANCE MANAGEMENT

© 2025 Stratis Advisory LLC. All Rights Reserved.

Terms of Use | Privacy Policy